Find correlated stocks

For this article we are going to focus on selecting those stocks that show an absolute value of the linear correlation nearly equal to 0. Ad 0 Online Listed Equity Trades And Powerful Tools.

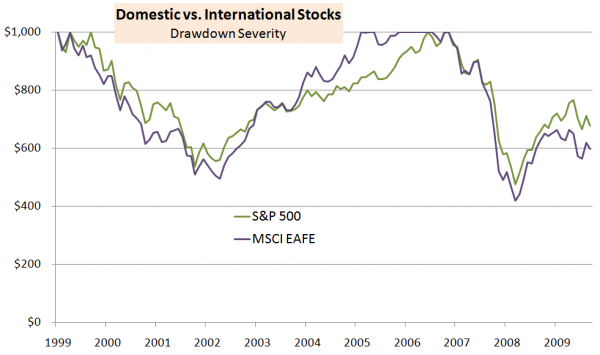

Diversification 10 Investments That Don T Correlate With The S P Seeking Alpha

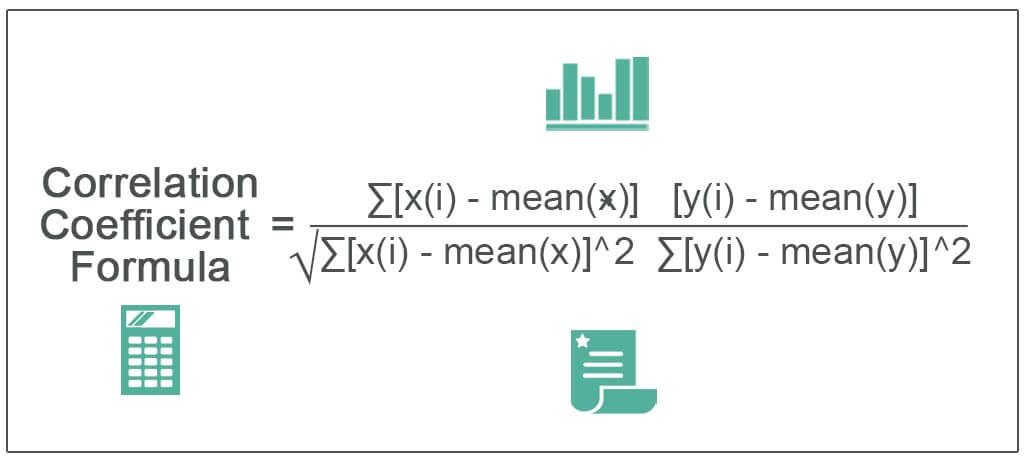

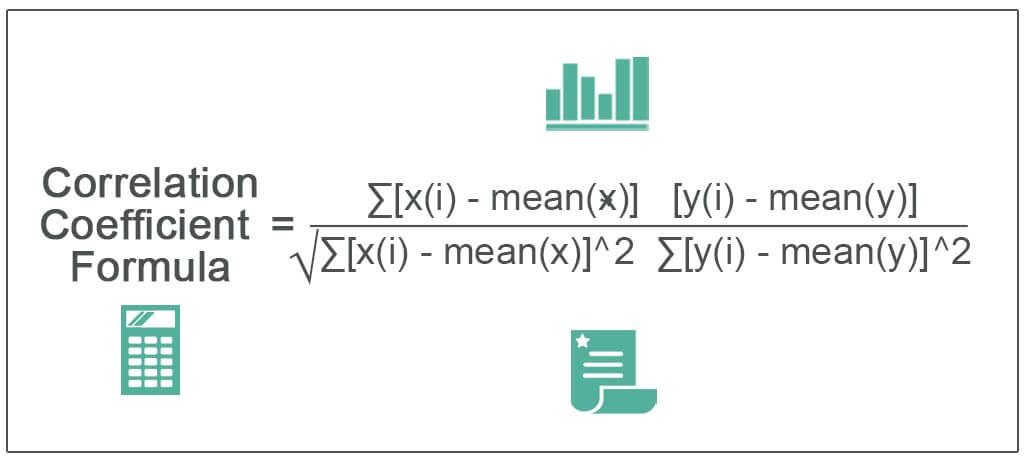

To find a correlation between two stocks you can start by determining the average affordability of each.

. As an example it is a fairly safe assumption that the tanker shipping industry is going. Pick a period then. Stock Correlation will give you the top 20 most highlyinversely correlated tickers.

Find out why it could still go higher. Find top correlated stocks with any ticker you choose. And from all of these.

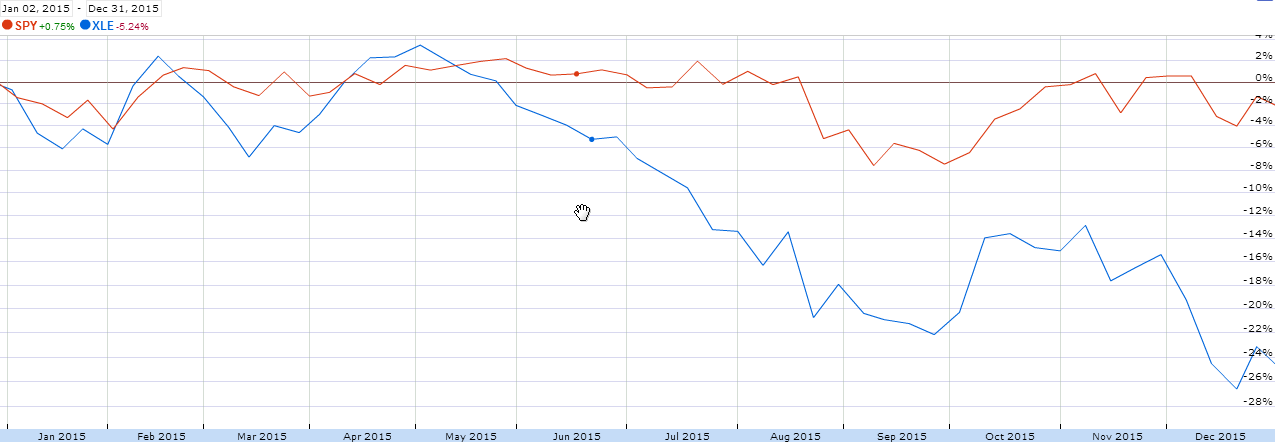

On Google Finance I can draw the chart for SPY for the last 5 years and then individually I can compare other stock. Open A Brokerage Account Today. Top 1000 Most and Least correlated assets on the market.

We have three steps to follow to find the correlation. The Correlation Screener tool can be used to find both positively and negatively correlated holdings. You also view the rolling correlation for a given number of.

Ad This analysts last stock recommendation jumped over 300 in 4 weeks. This asset correlation testing tool allows you to view correlations for stocks ETFs and mutual funds for the given time period. Simply enter any two stock symbols and select the price series and date information.

Simply put stocks have fantastic momentum in most intraday moves. To find the influence between two stocks you need to find the average price of each. The first step is to add up the values of each variable.

We will walk thru the formula which is not as ugly as it. Pick a period then shuffle each stocks daily. In this part of the article we.

What does correlation mean. The Top 20 most positively correlated stocks will be listed on the left and Top 20 most negatively correlated stocks will be listed on the right. You can scan through every stock and ETF listed on the NASDAQ and.

This might need more expert analysis to validate the reason behind correlation. Dont Settle For Less. Index funds attempt to match the performance.

For example I want to find stocks that are negatively correlated wrt SPY. On the opposite end of the spectrum two stocks that move at the same rate in opposite directions have a perfect negative correlation or a correlation of -10. For example if two.

The stock this analyst recommended keeps going up. Several cement stocks are highly correlated with Banks now this might be a genuine relation. A volatile stock simply means that it is moving.

Then click on the Calculate Correlation button and the correlation coefficient will be displayed on a new. Index funds use this as a strategy. What is an example of a highly correlated stock.

How do you find the correlation of a stock. The next step is to add up Ys value and multiply each value of x by y. The site provides various tools all focused on correlation diversification and portfolio construction.

Comparing individual stocks to market indexes is one way to use stock correlation. Every day we calculate more than 21000000 correlations yes 21 million among assets all over the world.

U S Stock Market Sectors Correlations Seeking Alpha

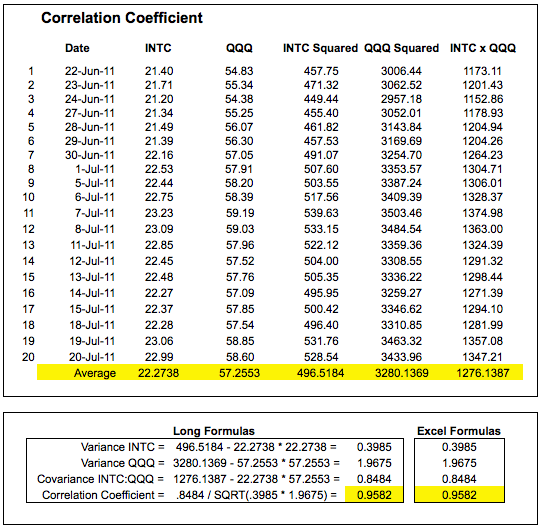

Correlation Formula How To Calculate Step By Step

How To Use The Correlation Coefficient To Build A Diverse Portfolio Tpa

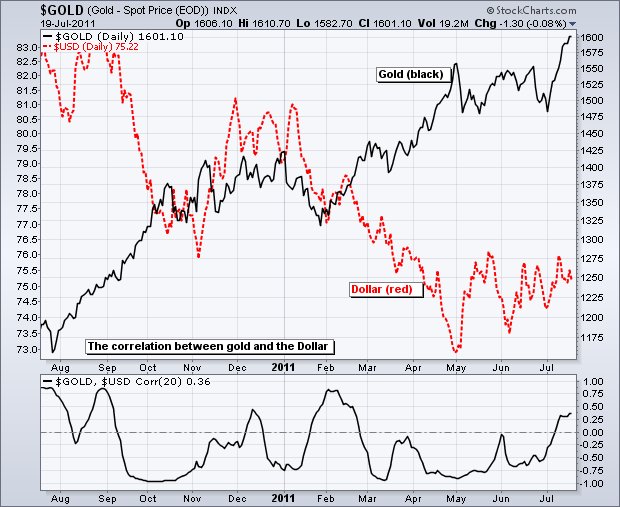

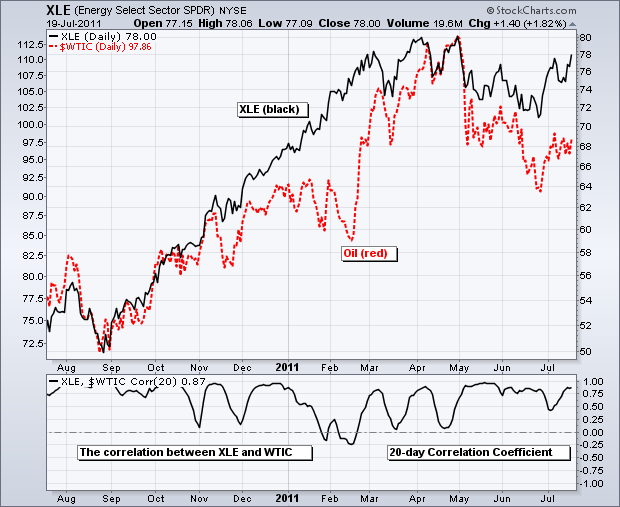

Correlation Coefficient Chartschool

Correlation Coefficient Chartschool

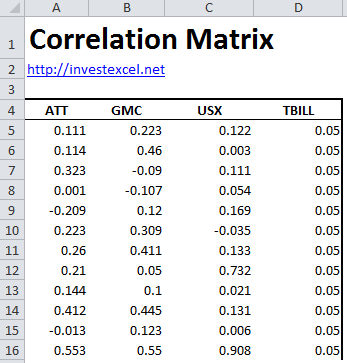

Correlation Matrix Guide And Spreadsheet For Investors

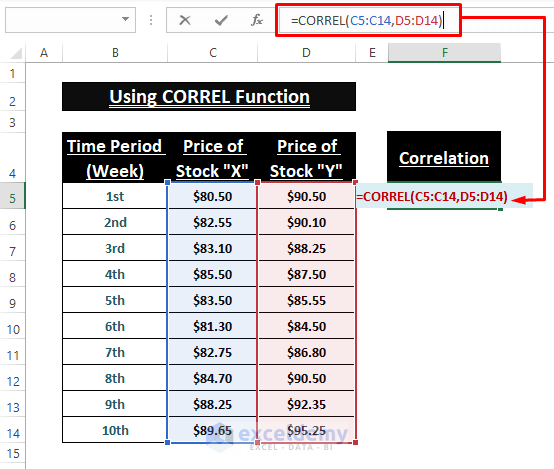

How To Calculate Correlation Between Two Stocks In Excel 3 Methods

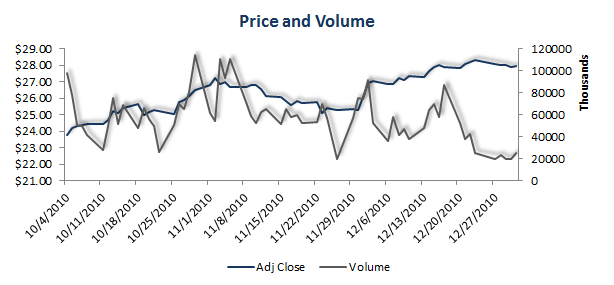

Price And Volume Correlation Seeking Alpha

What Is Stock Correlation And How Do You Find It

How To Calculate Stock Correlation Coefficient 12 Steps

How To Calculate Stock Correlation Coefficient 12 Steps

How To Find Correlated Stocks And Alpha Beta Values Edgerater Academy

What Is Stock Correlation And How Do You Find It

How To Calculate Stock Correlation Coefficient 12 Steps

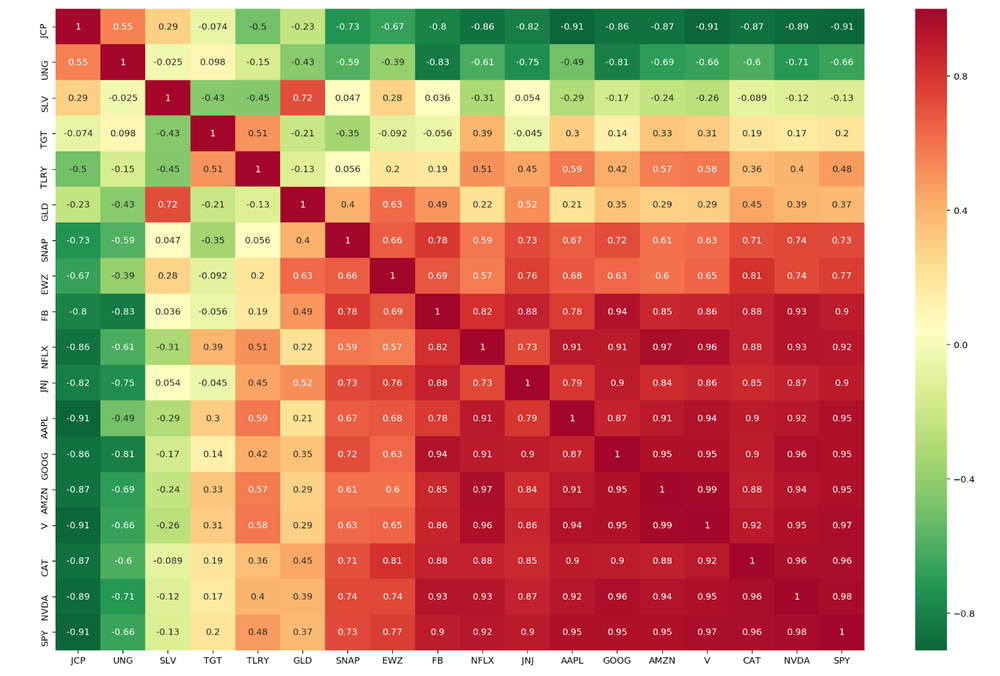

Risk Part 4 Correlation Matrix Portfolio Variance Varsity By Zerodha

Easily Visualize The Correlation Of Your Portfolio In Python

Correlation Coefficient Chartschool