33+ mortgage payments tax deductible

Web There is a simplified home office deduction approved by the IRS that you can use up to 1500 which is the set dollar amount of 5 per square foot of your home. Web The home with the secured loan must have sleeping cooking and toilet facilities.

Financial Risk Types And Example Of Financial Risk With Advantages

Ad 5 Best Home Loan Lenders Compared Reviewed.

. Web The mortgage is acquisition debt for a qualified residence a new mortgage. Web You can only deduct a total of 10000 5000 for those married filing separately for property taxes plus state and local income taxes or sales tax instead of. Taxes Can Be Complex.

Choose Smart Apply Easily. Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage. The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

Comparisons Trusted by 55000000. Web Mortgage tax deductions and other homeowner costs were affected by the federal governments 2018 tax overhaul. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. The coverage protects the lender in. Web Is mortgage insurance tax-deductible.

However higher limitations 1 million 500000 if married. Looking For Conventional Home Loan. Web In order for your mortgage payments to be eligible for the interest deduction the loan must be secured by your home and the proceeds of the loan must have been.

Compare Lenders And Find Out Which One Suits You Best. Special Offers Just a Click Away. Web The mortgage interest deduction is a tax incentive for homeowners.

Ad Compare the Best Mortgage Lender To Finance You New Home. Ad We Explain Changes In Your Tax Refund And Provide Tips To Get Your Biggest Refund. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Can you write off mortgage payments. 485 33 votes Health insurance premiums are deductible on federal taxes in some. Web Mortgage interest is tax deductible.

Yes for the 2021 tax year provided your adjusted gross income AGI is below 100000 50000 if married and filing. The debt cant exceed 750000 or 1000000 if the loan was taken before. Homeowners who bought houses before.

This itemized deduction allows homeowners to subtract mortgage interest from their taxable. Web If youve closed on a mortgage on or after Jan. Web Most lenders require private mortgage insurance or PMI when a buyer cannot make a down payment of at least 20 of the purchase price.

For example Lenas first-year interest expense totals 14857. However even if you meet the criteria above the mortgage insurance. 1 2018 you can deduct any mortgage interest you pay on your first 750000 in mortgage debt 375000 for.

12950 for single and married filing separate taxpayers. Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Web For the 2022 tax year meaning the taxes youll file in 2023 the standard deduction amounts are.

At a personal tax rate of 24 this implies tax savings of 3566 in just the first year of. Web Is mortgage interest tax deductible. Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

You itemize your deductions. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. We dig into the details about current mortgage.

New York Foreclosure Defense Law Office Of Yuriy Moshes

Mortgage Interest Deduction What You Need To Know Mortgage Professional

The Home Mortgage Interest Deduction Lendingtree

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

The Home Mortgage Interest Deduction Lendingtree

Are Mortgage Payments Tax Deductible Taxact Blog

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

How Much Money Do I Get In Hand For Ctc Of 33 Lakh Inr Quora

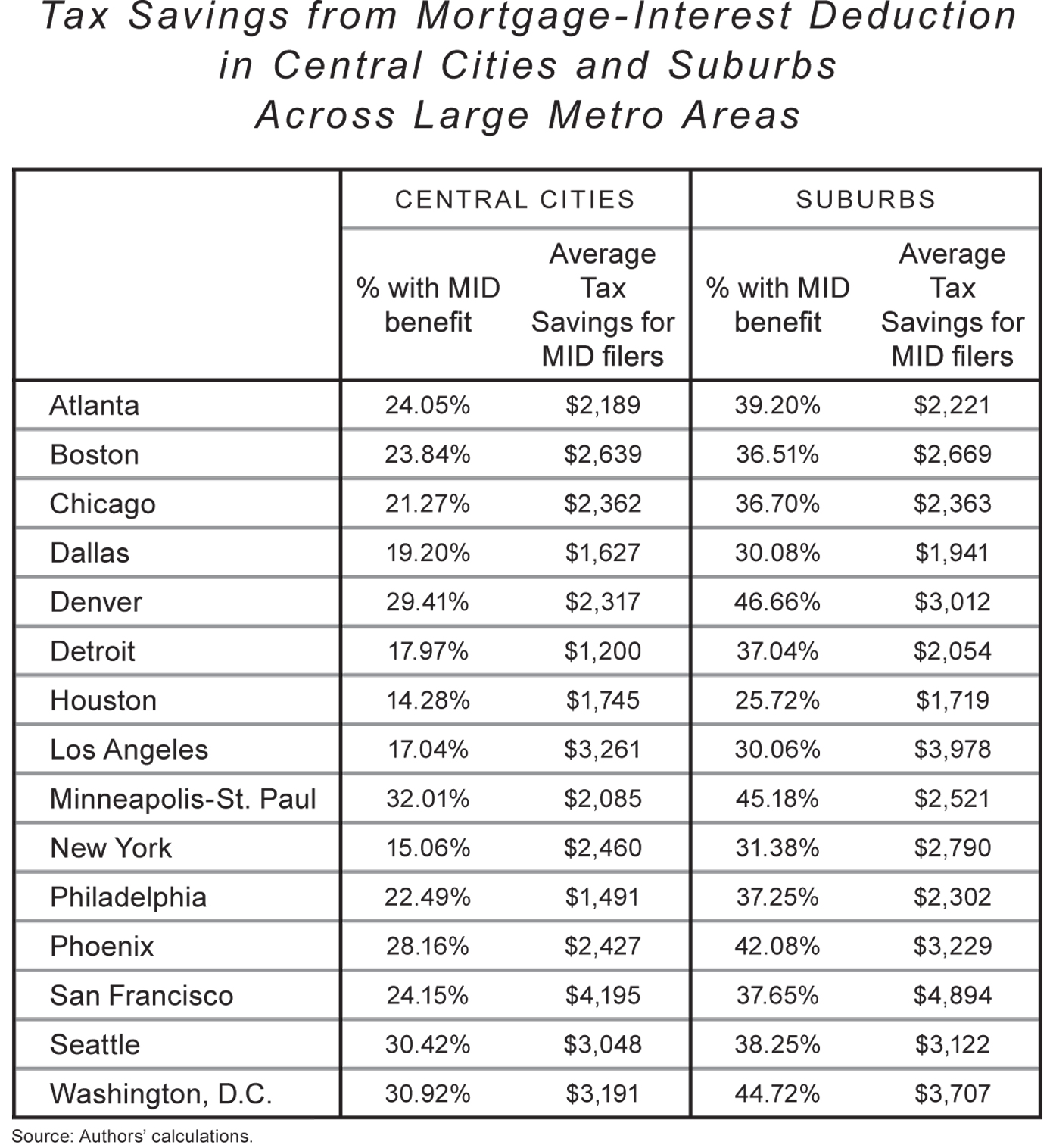

Rethinking Tax Benefits For Home Owners National Affairs

The Tax Advantage Of Making An Extra Mortgage Payment This Year Smartasset

Are Your Mortgage Payments Tax Deductible In 2022

How The Big 6 Tax Plan Would Downsize The Mortgage Interest Deduction

Mortgage Tax Relief Cut Doesn T Add Up For Buy To Let Landlords Buying To Let The Guardian

33 Free Editable Amortization Schedule Templates In Ms Word Doc Pdffiller

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Betterment Resources Original Content By Financial Experts